EU, and the political elites behind it, is no longer a caricature or a joke. They have managed to become a joke of a caricature. An absurd Alice in Wonderland economic and political farce is playing out and the common people of Europe is, as usual, paying the price.

Here is just some updated data to some of my previous posts. It ain’t pretty to say the least!

(See my posts:

This is why the Euro is doomed

EU – an unaccountable mess created by an undemocratic treaty – Now also a crony Bankocracy)

The EU Crisis is anything but over regardless of what the political elites are trying to tell people in Europe. The ECB may have pushed the banking crisis temporarily back by promising unlimited bond buying. Yes, dear people, read that again – UNLIMITED!

That’s your tax money spent like a drunken sailor.

But soon there is NO MONEY LEFT.

So here we go again for the 7th, 8th or is it the 9th time so far – Europe’s banking system is breaking down again. No surprise to anybody expect or politicians and bankers.

Just start adding up the GIGANTIC NUMBERS and be utterly horrified!

This is the situation that politicians and the banks have put the common people of Europe in.

They are literally ruining us all. And WE, the common people, have to pay the price of their folly and speculations.

As a longtime observer of EU noticed:

“Then again, on the insolvent continent, nothing really surprises us any more.”

And:

“How can broke economies lend money to other broke economies who haven’t got any money because they can’t pay back the money the broke economy lent to the other broke economy and shouldn’t have lent them in the first place because the broke economy cant pay it back”.

Even a 5 year old can understand this. But not “our” politicians and bankers.

Remember that the Euro was always a political project. That’s why “they” haven’t done the”proper” economic policies. Because these policies would undermine the political purpose of the Euro. So they, the political elites of EU, are trapped. And that’s why the Euro was domed from the beginning.

And of course, none of this is covered in the mainstream/old media or by our “dear” politicians.

Greece

Greek Bank Capital Needs at EU27.5 Billion, Bank of Greece Says

“Greece’s four largest banks need to boost their capital by 27.5 billion euros ($36.3 billion) after taking losses from the country’s debt swap earlier this year, the largest sovereign restructuring in history.

National Bank of Greece SA, the country’s biggest lender, needs to raise 9.8 billion euros, according to an e-mailed report by the Athens-based Bank of Greece (TELL) today. Eurobank Ergasias SA (EUROB) needs 5.8 billion euros, Alpha Bank (ALPHA) needs 4.6 billion euros and Piraeus Bank SA (TPEIR) needs 7.3 billion euros, according to the report. Total recapitalization needs for the country’s banking sector amount to 40.5 billion euros, the report said.”

To put this in perspective: The entire capital base of the Greek banking system is only €22 billion.

By saying that Greek banks need €27.5 billion Greece is essentially admitting that is needs to recapitalize its entire banking system. Also, you should know that Greek banks are still sitting on €46.8 billion in bad loans.

So the Greek banks have a capital base of €22 billion and bad loans of €46.8 billion.

There is a name for this – Bankrupt!

And remember, this is AFTER ALL the “rescue plans”, bailouts etc. already implemented so far by the “Troika” (IMF, ECB and EC).

Cyprus

Cyprus is the euro area’s third-smallest economy in GDP terms, accounting for less than 0.2% of the region’s output. Yet the country urgently needs external funding and applied for an Troika (EC/IMF/ECB) programme last summer. In the meantime, the amount in question has risen to EUR 17.5bn (100% of GDP).

Read that again – 100% of GDP!

By mid-2012, larger banks like Bank of Cyprus or Cyprus Popular Bank alone reported loans to Greek borrowers that exceeded Cyprus’ GDP.

The Cyprus central bank’s emergency liquidity assistance (ELA) to the banking system skyrocketed from EUR150m in March 2012 to EUR 9.9bn (55% of GDP) in September.

So the Cyprus central bank only in September but in 55% of the whole Cyprus GDP into its own banking sector.

Spain

Bankia worthless says new report

http://www.euronews.com/2012/12/27/bankia-worthless-says-new-report/

“Bankia’s shareholders have received a nasty new year’s surprise. They may lose most of their investments or even all of them says the Spanish bank rescue fund in its latest report.

According to FROB, the Fund for Orderly Bank Restructuring, Bankia has a negative value of 4.2 billion euros, and its parent group BFA is 10.4 bn in the red.

Valuation is key in the recapitalisation of Spain’s banking system, weighed down by massive bad loans accumulated in a property bubble that burst in 2008. Bankia/BFA is set to receive 18 bn euros of European aid, and become the country’s biggest bailout recipient.”

A little known fact about the Spanish crisis is that when the Spanish Government merges troubled banks, it typically swaps out depositors’ savings for shares in the new bank.

So when the newly formed bank goes bust, your savings are GONE. Not gone as in some Spanish version of the FDIC will eventually get you your money, but gone as in gone forever.

This is why Bankia’s collapse is so significant: in one move, former depositors at seven banks just lost virtually everything.

In addition, things are going from worse to worst, as bad loans in Spain continue to accelerate to massive new record highs.

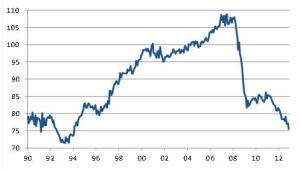

Index of Spanish Industrial Output

Italy

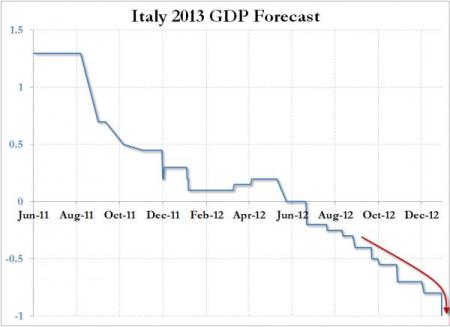

In Jan 2012, Italy’s government believed Italy’s 2012 GDP would come in at – 0.4%. The actual in (Q3) – 2,4% (so far). Only a miss by 600%.

And the forecast for Italy’s GDP in 2013 is being lowered every month. Each one as inaccurate as the previous one.

And then there is Ireland, Portugal, France….

Part two tomorrow about USA.

Läs även andra bloggares åsikter om http://bloggar.se/om/milj%F6” rel=”tag”>miljö</a>, <a href=” http://bloggar.se/om/yttrandefrihet” rel=”tag”>yttrandefrihet</a>, <a href=”http://bloggar.se/om/fri-+och+r%E4ttigheter” rel=”tag”>fri- och rättigheter, Läs även andra bloggares åsikter om http://bloggar.se/om/USA” rel=”tag”>USA</a>

Etiketter: a ghost, Against the will of the people, Alexis Tsipras, Alfredo Perez Rubalcaba, Angela Merkel, Anger, At ALL COST, Bailout, bailout package, bailout plan, bailout terms, bailouts, bankocracy, bankrupt ruling elite, Banks, Baroness Ashton, Berlusconi, bond market, Britain, broke, broke economies, Bryan Dawe, Bunker mentality, Catherine Ashton, CCC, Cecilia Malmström, Central banks, China, Clarke and Dawe, collapse, corruption, Council of the European Union, crony Bankocracy, crony capitalism, Cyprus, dangerous people, David Cameron, debt crisis, Debt increase, Debt level, debt rescue, Developing Asian economies, dividend tax, Domenico Lombardi, dustbin of history, ECB, ECB's Executive Board, ECB's Governing Council, Economic and Monetary Affairs, economic crisis, EEAS, emergency meeting, EMU, EU, EU ambassadors, EU constitution, EU foreign minister, EU institutions, EU is the Stupid Empire, EU mess, EU officials, EU Parlamentet, EU's president, Euro, Euro Group, Euro-State, Europe of Freedom and Democracy, European Commission, European Commissioner, European Council, european debt, European Finance ministers, Eurozone, Eurozone in crisis, Evangelos Venizelos, Fanaticism, Fear, Federal State, finance, foreign reserves, France, Germany, GIGANTIC NUMBERS, Global Warming Hysteria, Great Britain, Greece, Greece election, Herman Van Rompuy, IMF, inflation, Ireland, Italian Prime Minister, Italy, Jean-Claude Juncker., Jean-Claude Trichet, John Clarke, José Manuel Barroso, Korruption, Lissabonfördraget, local parliaments, Lucas Papademos, maneuvering, Margot Wallström, Mariano Rajoy, Mario Monti, MEP, monetary policy, more integration, national debt, national government borrowing, national governments, National parliaments, Nicolas Sarkozy, obsession, Olli Rehn, Peter Hitchens, policymakers, political elites, political influence, Politicians, Politik, poorest Americans, poorest households, Portugal, price stability, referendum, Regeringen, rescue package, Riksdagen, rubber-stamping Brussels decisions, SGP, Silvio Berlusconi, Spain, Spain’s Regional Debt, Spanish bad loans, Standard & Poor's Ratings, Surrendered, Syriza, The 7.30 Report, The Big picture, The Ecofin Council, The Economic and Financial Affairs Council, the Emergency, the EU project, the euro area, the European Union, The game is up, The Greece budget, The Greece Finance Ministry, the High Representative for Foreign Affairs, the Lisbon Treaty, The Stability and Growth Pact, the Swedish parliament, The Troika, the unemployment picture, They are the same, total meltdown, UK, WEO, William Hague, World Economic Outlook, World GDP

9 mars, 2013 kl. 11:12 e m |

[…] The economic mess and structural problems in EU and US – Part 1 […]

3 april, 2013 kl. 7:18 e m |

[…] For some background on Cyprus see my post: The economic mess and structural problems in EU and US – Part 1 […]

2 december, 2013 kl. 8:42 e m |

[…] The economic mess and structural problems in EU and US – Part 1 […]